Goods & Service Tax, CBIC, Government of India :: Home

Table of Content

And you can track the action made or the status of your complaint using your Grievance Number. Similarly, the entire GST registration process can be completed online on the WWW.GST.GOV.IN portal within minutes. Also, registration is completely free and one need not have to pay any registration fees online. However, if you are appointing any professional to get this work done, he may charge his fees.

I) Return Dashboard – Contains all the details about the returns the taxpayer paid and compares liability declined with the ITC claim. This ledger has the details of ITC available to the taxpayer, and this credit can be used to pay off the tax liability. Every time you claim your ITC, it is credited into this ledger.

Who should get registered on the GST Portal?

However, in many cases, you may want to check the status by entering the TRN number. The other options available on gov in portal under ‘Search Taxpayer’ includes the link to search taxpayer who has opted in or out of the composition scheme. One needs to search by entering GSTIN/UIN details or search by state from where registration was done.

Using this option, you can claim a refund for the GST you paid by selecting the proper reason for the refund. Vi) New Return – Here, you can select the new type of return you want to file introduced recently. Iv) ITC forms – You can prepare different ITC forms in both offline and online format from here. You can know the government holidays for the GST practitioner and others using this option. In GST, goods are classified by the Harmonised System of Nomenclature code.

GST portal login search taxpayer

With this, he can avail of the benefits of an unregistered applicant under the GST Portal. If the tax office is not satisfied with your application details, he will ask for clarification . At this time, you can opt for providing the clarification through this online portal. Registration option on GST PortalThe first tab you will see under Service Menu is the Registration.

One of the best features of GST in India is that it comes with an online website hosted by the Government of India for its taxpayers. Therefore, those days are gone when the taxpayers were waiting for the officer to come to the office to discuss the matters. Then kindly go through the instructions to view the current status of your application for registration.

Annual GST Returns

Sales tax could continue to be levied by the states on these products with the overall floor rate. Similarly, the Centre could also continue its levies. After further deliberations, we will issue a final opinion on whether we should keep natural gas outside the GST. Click on ‘File form with DSC’ or ‘File form with EVC’.

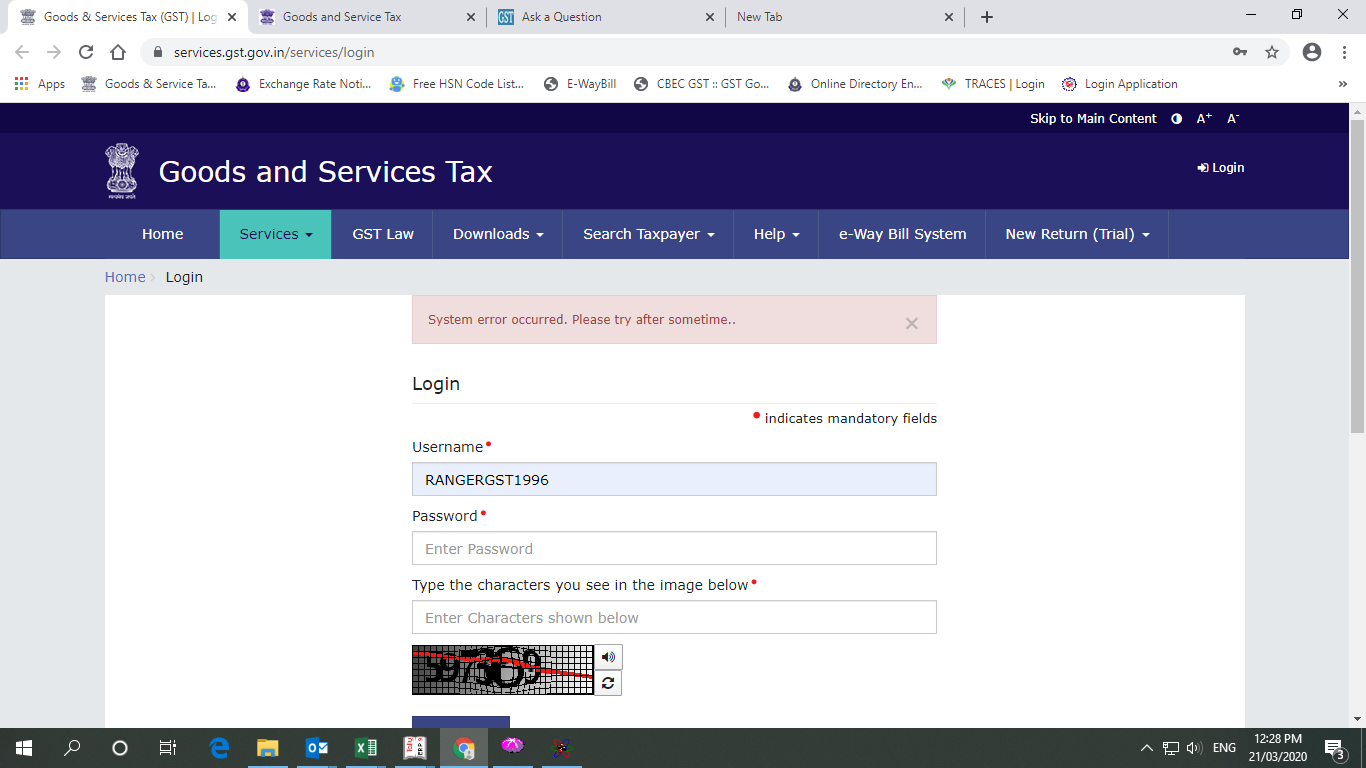

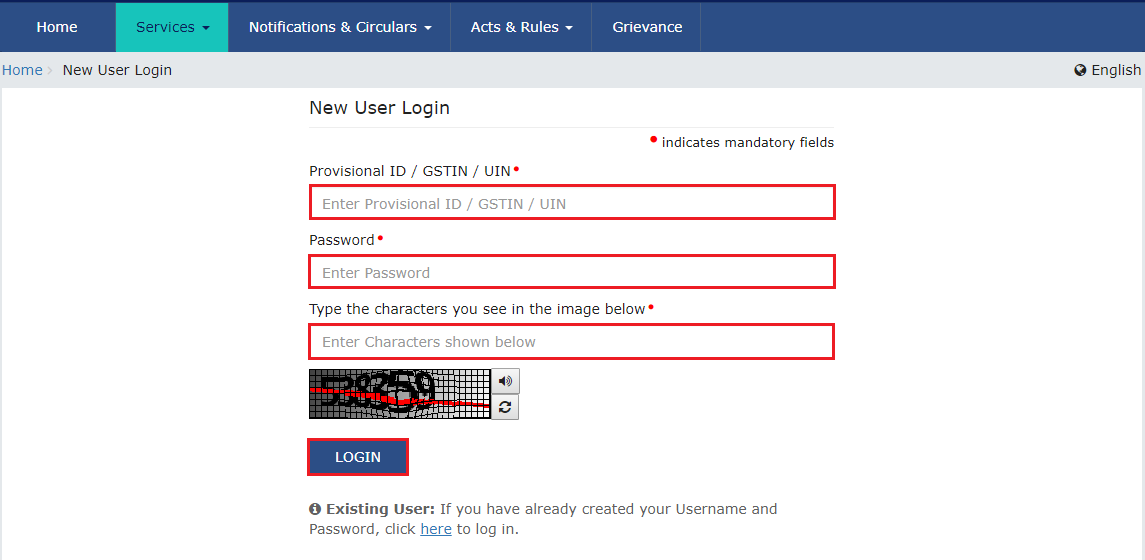

In the ARN field, enter the ARN received on your e-mail address when you submitted the registration application. Then input the username and password of your choice if available. Re-confirm the password again and then click on the Submit tab. Complete the GST online payment on the login portal.

The system will show the status of your application on the screen. Please refer to various “application status types” in the below subtopic. This article will tell you how to log in to the GST portal after submitting the GST Registration application. This chapter includes pre & post-GST login and log-in by TRN.

Vii) Transition Forms –Here you can select the type of transition form, which helps to settle your tax liability under old Indirect Tax reform. Cause list consists of all the dates of hearings or orders issued by the Tax official or Jurisdiction. Click on the “Change password” link from the left-hand menu. Now you can see the current status of the application under the Status column. A) Enter the Submission Period of the application using the calendar and click on the SEARCH button.

You can now successfully login into theGST Portalusing these credentials created. The users should exercise due caution and/or seek independent advice before they make any decision or take any action on the basis of such information or other contents. A user needs to register on the GST portal and log in to view the dashboard. Under News – Updates section, users can check the latest news on GST, including any change in due dates, GSTN system updates and any change in the filing processes. Below is the official video of GSTN explaining the GST portal’s Return dashboard.

In addition to it, there is an Accounting and billing software sub-category that shows the list of Accounting or billing software of the third parties vendors. You can select your best tool or software based on the description, features, and system requirements. Under the Important Dates section on the gov my login portal, users will find information on GST returns deadlines, changes in dates, etc. The latest tab on the GST government login portal gives users access to an e-invoice portal. Here, one can find FAQs related to the e-Way Bill System to get more information. Users can click on the relevant link to go to the e-Way Bill portal, where one can find various options, including e-Way Bill registration.

When an e-Way Bill is generated on the portal https // login, the user is given a unique e-Way Bill Number . The transporter, recipient and supplier will receive a unique e-way bill or EBN allocated to them. Then, go to the login page and enter your new GST portal login password credentials.

It will take some time for the tax officer to verify your application details; you can check your application status through the Application Reference Number using this option. Service Tab – GST PortalThis tab consists of all the services provided in the GST Portal, and this is the frequently used tab by the taxpayers. Another thing is, in the GST portal, only if you are logged in can you access the full contents. Despite the user-friendliness, some new taxpayers struggle to understand the contents of the GST login portal. So today, I am going to take you on tour, here are things covered under this article.

Enter the OTP received on the registered mobile number. Click on the Forgot password link as shown in the above section. We updated all Our API's and software's to make you more Comfortable. Provide your official address and proceed with the Save and Proceed Option. Click on the Services tab, the Registration tab, and select Application for Cancellation of Registration. It would generate an acknowledgement number on submission of all the required details and documents.

Comments

Post a Comment